Must Have Toolkit

- You have decided to invest in real estate and grow a portfolio of highly profitable properties.

- You have read books, attended training courses and conferences on the matter to be one step closer to materializing your goal.

- Lastly you have put your finances in order, received private and/or public funding and you are ready to take action.

Each of these steps are significant accomplishments in the process of becoming a profitable real estate investor. What’s next? Acquire the essential tools to execute your plan successfully.

Multiple Listing System (MLS)

The MLS is an inventory of properties for sale continuously replenished and accessible by a vast network of real estate agents through the National Association of Realtors. Did you know that 9 in 10 buyers (88%) purchase a property through a real estate agent? Also did you know that only 9% of sellers go the route of For Sale by Owner (FSBO)?

The MLS is key in maximizing your investment opportunities. Even buyer facing sites like Zillow and Trulia depend on MLS property data. What sets the MLS apart is that both Realtors and the system are highly regulated and data is more current and more accurate as a result. Ask your Realtor to give you access to the source and be the first one to know about homes hitting the market. It’s a world of a difference that gives you a competitive edge.

Investors! Contact the Velez Real Estate Group To Help You Find The Best Property (954) 362-9095

Comparable Market Analysis

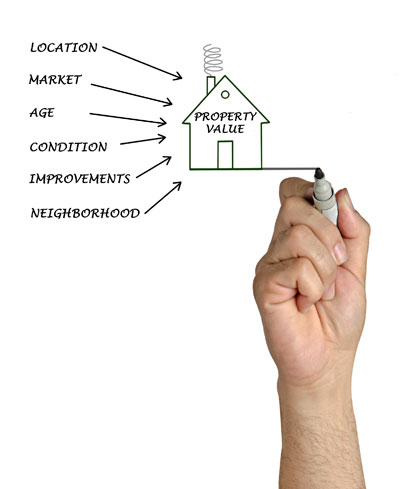

Once you have toured a selection of properties and identified your top 2 to 3 options its time to determine property value for each. A Comparable Market Analysis (CMA) is a detailed evaluation of the subject property with respect to properties with similar features, attributes and conditions that have sold within a recent time-frame.

The process involves adjustments to account for differences affecting value like water view, pool, lot size or extra room. The goal of a CMA is to arrive at the property value based on recent activity of the local market that would assist you in presenting an educated and competitive offer.

Return on Investment Model

Now that you know the property values, which property should you choose to present an offer? It’s time to plug the numbers in your Return on Investment (ROI) model to determine which is the most lucrative. What ROI model you use would depend on your objective: flip or rent.

Our Clients Love Us – See What They Have To Say!

Contract and Addendums

Entering into a real estate contract is legally binding and not to be taken lightly. Contract documents must include terms and contingencies to protect you and allow you to retract, for instance, if you are not satisfied with inspection results or contract price is above appraisal value.

You may choose to pay a Real Estate attorney to prepare these documents or contact a Realtor and access their approved and comprehensive contract forms and addendums for FREE. Whether a buyer uses his own agent or not, the seller still pays the same commission. Might as well find a buyer agent whose first priority is you and not the seller.

Transaction Management

Once under contract, time is of the essence to fulfill contract terms, meet contract deadlines and coordinate a series of activities with other experts before reaching the closing table. Inspections, appraisal, survey, association approval, insurance quotes and procurement, loan approval and funding, title search and closing documents preparation, etc. Keeping every step and every party involved on track requires a well-organized, experienced, dedicated full-time resource. Your escrow deposit and more could be at stake should you default on contract deadlines.